Returns

Returns Arise from Profitability Mechanisms

The profitability of Sophos does not come from luck or coincidental decisions. It is the result of strictly engineered design, where every process follows cause-and-effect logic. As in an engineered structure or seismic design, all components complement each other, anticipate the unpredictable, and protect the framework, transforming chaos into disciplined and controlled operation.

1. Profit-to-Risk Ratio

Defining a profit target as a multiple of risk (3R, 5R, 7R, or more) is a mathematical constant of the system. This means that the very geometry of the decision ensures an advantage, regardless of the percentage of winning trades.

2. Alignment with the Trend

Sophos does not act in an environment of uncertainty. It first detects and confirms the direction of the trend and then follows it. The design excludes random entries, increasing the probability of achieving the targeted profit-to-risk ratio.

3. Portfolio Recycling

Capital remains constantly active through a recycling mechanism. Once a position closes, a new one opens that meets the requirements, without ever exceeding the predefined risk limit. The system functions like a circular machine: nothing remains idle, nothing escapes control.

4. Targeted Watchlist

Product selection is not random. It is based on fundamental performance parameters or strategic value. The methodology is applied only to instruments capable of delivering returns, reinforcing the stability of the mechanism.

5. Dual Direction

The design does not allow one-sidedness. Sophos operates under the same strict rules whether prices rise or fall. Long and short positions are governed by exactly the same logic of risk and target.

6. Profitability in Any Environment

The consistency of the mechanism leads to a simple but powerful conclusion:

-

When prices rise, Sophos can profit.

-

When prices fall, Sophos can also profit.

7. Professional Architecture

Sophos is a product of engineering thinking. It was designed with the same strict logic an engineer uses to build a protection system or a bridge: with structure, consistency, and predictability. It is not merely trading software but a complete engineered system of trading and risk management.

Its architecture follows principles similar to those used in hedge funds, where discipline and systematization are absolute. The difference is that this professional approach is transferred to the scale of the individual investor, giving access to mechanisms normally reserved for institutional players, but with the flexibility, reliability, and innovative engineering design required for high and stable returns — advantages often absent even in hedge funds.

8. Summary

SOPHOS does not promise certainties. It offers a trading architecture designed with engineering consistency, which has demonstrated high performance dynamics in medium- to long-term application, surpassing even the most profitable and sophisticated investment vehicles (hedge funds, mutual funds, etc.), when comparing returns relative to risk. Its logic is based on strict risk control and on exploiting trends through technical and structural position building, aiming at geometric capital growth.

The returns achieved are not the result of luck or isolated moves, but of systematic rule-based application. SOPHOS seeks high annual return rates within a stable framework of initial capital protection.

It must be clear: markets involve risk. There are no guaranteed profits. But there is a fundamental difference between a random approach and an engineered method that allows controlled exposure and disciplined trend management.

The dynamics of SOPHOS are evident in multi-year simulations and real market conditions: the system can achieve returns far above the average of even the most profitable investment options, while maintaining constant maximum risk per trade. This balance between protection and growth is the foundation of its operation. Returns depend on market timing, product selection, operating parameters aligned with the user profile, and consistent application.

Sophos Settings Packages

Sophos is provided with three ready-made configuration profiles for different investment preferences:

Package: Conservative

Characteristics:

-

Low risk

-

Smaller drawdowns

-

Stable returns

Package: Moderate

Characteristics:

-

Balanced risk and return

-

Medium drawdowns

-

High long-term efficiency

Package: Aggressive

Characteristics:

-

Higher risk

-

Larger drawdowns

-

Dynamic returns for long-term investors

All packages provide a high level of security. Sophos is locked in every case and prevents reckless use by automatically rejecting any operation that exceeds the permitted risk level.

Additionally, custom configuration packages tailored to individual investment requirements are available for a fee. There is also a built-in option for each user to intervene and create a personal investment profile. However, such adjustments require special caution and genuine market experience. The performance of Sophos depends directly on the configuration. Incorrect parameterization can result in lower or even negative performance.

Recommendation: Use the ready-made configuration packages unless you have deep market knowledge and fully understand the impact of each setting on the way Sophos operates.

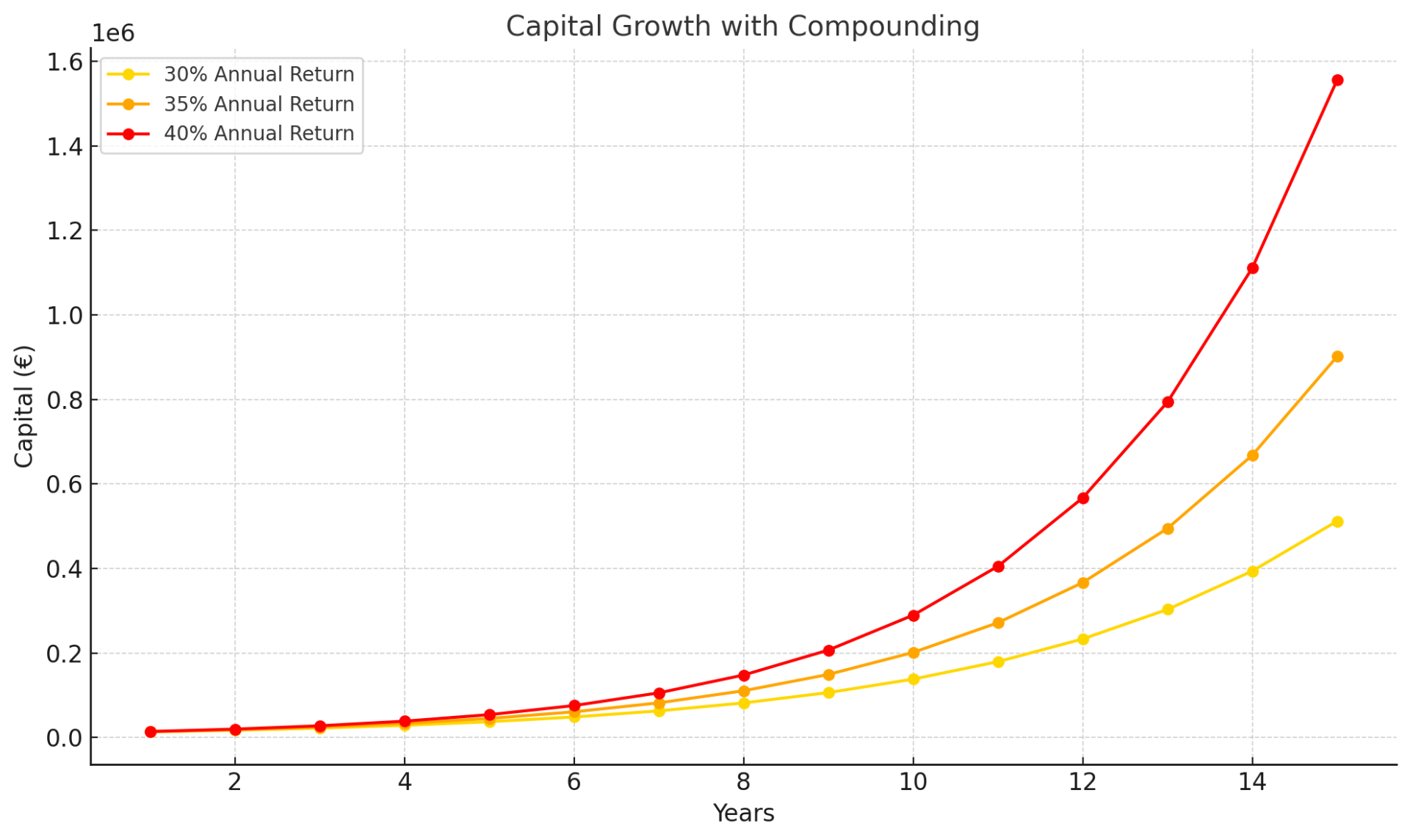

Capital Growth Scenarios with Annual Returns of 30%, 35%, or 40%.

Initial Capital: €10,000

Example 1: Average Annual Return 30%

-

Year 1

Capital: €13,000

Cumulative Return: +30% -

Year 2

Capital: €16,900

Cumulative Return: +69% -

Year 5

Capital: €37,129

Cumulative Return: +271% -

Year 10

Capital: €137,856

Cumulative Return: +1,279% -

Year 15

Capital: €511,850

Cumulative Return: +5,118%

Example 2: Average Annual Return 35%

-

Year 1

Capital: €13,500

Cumulative Return: +35% -

Year 2

Capital: €18,225

Cumulative Return: +82% -

Year 5

Capital: €45,138

Cumulative Return: +351% -

Year 10

Capital: €204,343

Cumulative Return: +1,943% -

Year 15

Capital: €924,388

Cumulative Return: +9,144%

Example 3: Average Annual Return 40%

-

Year 1

Capital: €14,000

Cumulative Return: +40% -

Year 2

Capital: €19,600

Cumulative Return: +96% -

Year 5

Capital: €53,785

Cumulative Return: +438% -

Year 10

Capital: €289,255

Cumulative Return: +2,793% -

Year 15

Capital: €1,555,727

Cumulative Return: +15,457%